Exploring the Ethereum Price GBP Landscape

Reviewed by Ella Green on January 21, 2026 at 03:30 PM. Recent analysis of the ethereum price in GBP indicates fluctuations influenced by market trends and investor sentiment.

Ethereum price GBP refers to the value of the Ethereum cryptocurrency measured in Great British Pounds. As a decentralized platform, Ethereum enables developers to build and deploy smart contracts and decentralized applications (dApps). This platform’s native currency, Ether (ETH), has gained prominence due to its utility and potential for innovation in various sectors, including finance, gaming, and supply chain management.

The Ethereum ecosystem primarily involves several key categories: Ethereum itself, associated tokens (often built on its blockchain), and decentralized finance (DeFi) applications that leverage its capabilities. As of 2023, Ethereum has seen widespread adoption, with thousands of projects running on its blockchain. This broad usage contributes to fluctuations in Ethereum price GBP, influenced by market demand, regulatory news, and technological upgrades.

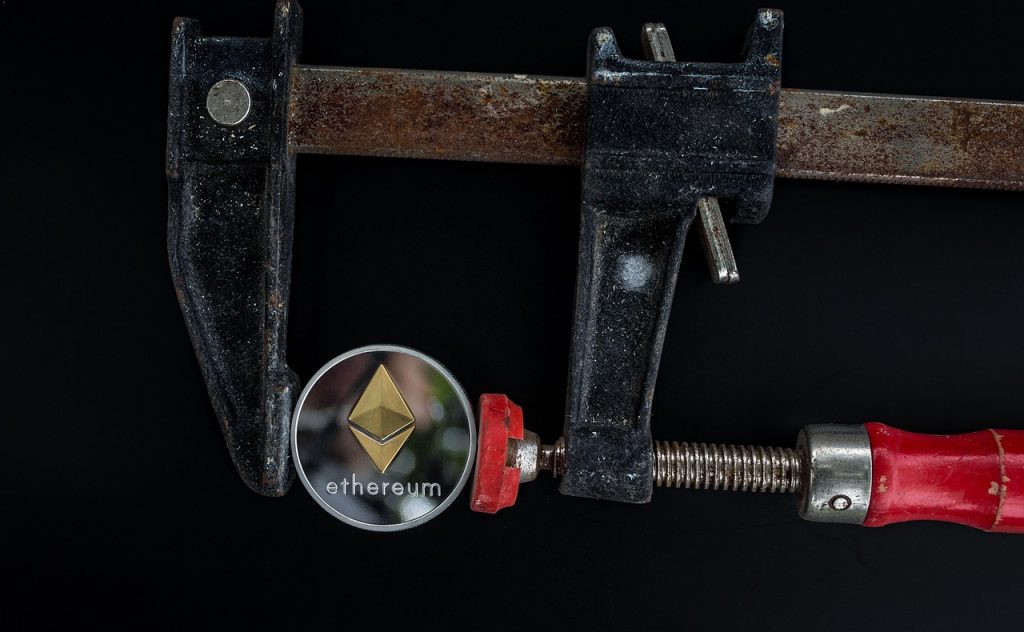

The image illustrates the interconnected components of the Ethereum ecosystem. Fluctuations influenced by market trends

Ethereum operates on a unique consensus mechanism called proof-of-stake (PoS), implemented with its transition from proof-of-work (PoW) in late 2022. This shift enhances network security and energy efficiency, enabling more users to participate as validators. Through staking, users can earn rewards, influencing supply and price dynamics.

Major factors influencing Ethereum price GBP include market sentiment, macroeconomic trends, technological advancements, and overall activity within the Ethereum ecosystem. Reportedly, in late 2023, Ethereum maintained a market dominance of around 20% among cryptocurrencies, highlighting its standing in the market. Price volatility remains a characteristic of cryptocurrencies, and Ethereum is no exception, often transitioning through cycles influenced by broader financial trends.

The image depicts the various elements that can impact Ethereum’s price movements. Decentralized applications on the platform

One must consider specific challenges when navigating the Ethereum price GBP landscape. Firstly, Ethereum is not ideal for users seeking rapid transactions or minimal fees; during peak network demand, transaction costs—known as gas fees—can become prohibitively expensive. Secondly, users looking for absolute anonymity may find Ethereum less suitable due to its public ledger. Lastly, for those desiring stability, stablecoins or less volatile assets might be preferable. These insights highlight that while Ethereum offers significant potential, it may not align with every user’s requirements.

1. Monitor Ethereum network upgrades like the transition to proof-of-stake.

2. Analyze market trends to identify potential price movements.

3. Assess volatility indicators to gauge risk.

| Factor | Description | Impact on Price |

|—————————|—————————————|————————–|

| Market Sentiment | Public perception of Ethereum | Can lead to price spikes or drops |

| Technological Updates | Innovations and upgrades to the network | Usually positive if well-received |

| Regulatory News | Government actions and policies | Can create uncertainty | Utility and potential for innovation

In practice, the interaction of these factors creates a dynamic environment for Ethereum price GBP. The price can be influenced by investor behavior, with irrational exuberance often leading to sharp appreciation, after which corrections may occur.

Additionally, adopting various strategies can shape user decisions. Many traders employ technical analysis or fundamental analysis to predict trends and make informed choices. Users can narrow their options by focusing on specific factors such as historical price data, technological analyses, or comparative assessments with Bitcoin.

Overall, understanding how the Ethereum price GBP fluctuates in the broader cryptocurrency landscape allows users to make more informed decisions. By weighing risks and opportunities, investors can navigate this complex space with greater confidence.

Moving forward, monitoring adoption signals is essential for anticipating Ethereum’s future trajectory. As more businesses integrate Ethereum-based solutions, demand could potentially drive prices higher. Ultimately, assessing Ethereum’s role in the market should align with individual investment goals and risk profiles. This proactive approach helps in making well-informed decisions while exploring future opportunities within this evolving ecosystem.

Key Takeaways

- The price of Ethereum in GBP is influenced by a variety of factors, including market demand, regulatory developments, and technological upgrades within the Ethereum network.

- Volatility in the cryptocurrency market frequently leads to rapid changes in the price of Ethereum, as seen in historical price fluctuations.

- Current exchange rates for Ethereum in GBP can be monitored on multiple cryptocurrency exchanges and financial platforms, providing real-time data for investors and analysts.

What factors influence the exchange rate of Ethereum to GBP?

The exchange rate of Ethereum to GBP is influenced by various factors, including market demand and supply, investor sentiment, regulatory news, and macroeconomic trends. Additionally, technological developments within the Ethereum network and broader cryptocurrency market dynamics can also impact its valuation.

How is Ethereum typically used in financial transactions?

Ethereum is primarily used for executing smart contracts and decentralized applications (dApps) that run on its blockchain. Users may engage in transactions that involve sending ether (ETH) for goods or services, participating in decentralized finance (DeFi) platforms, or trading on cryptocurrency exchanges, where they may convert Ethereum to GBP.

What are the risks associated with investing in Ethereum when converted to GBP?

Investing in Ethereum carries several risks, including high price volatility, regulatory uncertainty, and security vulnerabilities associated with exchanges and wallets. Additionally, market manipulation and the potential for technological failures can lead to financial losses for investors.

E

E

- Best Crypto Investments

- Bitcoin Investment Strategies

- Bitcoin Price Forecasts

- Bitcoin Trading and Investment

- Coinbase Investment Insights

- Crypto Day Trading Guide

- Crypto Investing

- Crypto Market Trends

- Crypto Mining Essentials

- Crypto Trading and Investment Guides

- Crypto Trading Insights

- Cryptocurrency Investment Strategies

- Cryptocurrency Wallets Guide

- Ethereum vs Bitcoin Insights

- Meme Coin Guide

- Online Stock Trading

- Shiba Inu and Dogecoin Updates

- Valuable Coin Guide

address analysis app best bitcoin buy buyers can card cheap credit crypto cryptocurrency debit decentralized dogelon driving ethereum exchange fast games gift how leveraged lookup mars memecoins mining near now prediction prices real should start stock today token trading usa verification wallet what where with

E

E

Exploring the Ethereum Price GBP Landscape

E

E

Ethereum Games Token Price – Understanding Ethereum Games...

E

E

Understanding the Risks and Trust Factors of Crypto Wallets

E

E

Understanding what stocks to invest in for long-term benefits

E

E